Student loan relief highlights burden on Black borrowers

3 min read

Gabrielle Perry, a 29-year-old epidemiologist in New Orleans, expects $20,000 of her $135,000 student loan debt to be wiped out under the plan announced this week by President Joe Biden. She is happy for the relief, but disappointed he isn’t fully canceling student debt that weighs especially heavy on African Americans.

For her, it’s discouraging that Biden isn’t doing more to help a constituency that played a critical role in his presidential campaign. Perry, who cares for and financially supports her disabled mother, said those obligations act as a societal tax on Black people, preventing the growth of generational wealth.

“You are ensuring that your little brothers and sisters have what they need for school,” Perry said. “You are helping your parents pay off their rent, their house. So your quote-unquote wealth doesn’t even have time to be built because you’re trying to help your family survive.”

Black borrowers on average carry about $40,000 in federal student loan debt, $10,000 more than white borrowers, according to federal education data. The disparity reflects a racial wealth gap in the U.S. — one that some advocates say the debt relief plan does not do enough to narrow.

One in four Black borrowers would see their debt cleared entirely under the administration’s plan, which cancels $10,000 in federal student loan debt for those with incomes below $125,000 a year, or households that earn less than $250,000. The plan includes an additional $10,000 in relief for Pell Grant recipients, who are more than twice as likely to be Black.

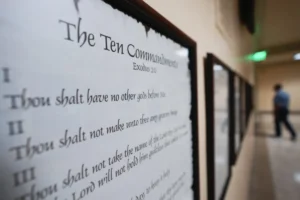

But more work needs to be done to make higher education accessible and affordable, said Wisdom Cole, national director of the NAACP Youth & College Division.

“When we think about education and higher education, fundamentally, it’s the promise of an equitable future,” Cole said. “We have so many Black graduates who go through the system, graduate and are not able to see that future because they disproportionately risk taking out loans.”

Perry faced steep challenges to complete her education. Homeless for nearly a year, she had to drop out of school and saw the interest on her loans balloon. She also faced incarceration. Eventually, she was able to get her record expunged and earned a master’s in public health from Tulane University, graduating just in time for the COVID-19 pandemic.

The pandemic-era freeze on student loan payments, combined with raises at work, allowed Perry to achieve a sense of stability for the first time in her life. She was able to pay off her car, help her disabled mother, and start a nonprofit, the Thurman Perry Foundation, that gives college scholarships to currently or formerly incarcerated women and their daughters.

“That time with that payment pause, it didn’t just build up my life,” Perry said. “It even helped me pull my mother out of poverty. I got her into a safer place to live. It reverberated for people like me. Because I know that there are other people living worse than what I survived.”

Black students are more likely to take on debt to finance their education, and in larger amounts, in part because of the wealth gap that makes it less likely for Black families to be able to finance their children’s education.

In her first months of graduate school, before her fellowship salary kicked in, TC Headley called the university’s financial aid office to ask if there was help to cover the cost of books and supplies. Instead, the woman on the phone told her to call her parents and ask for more money.